Loan Programs

FHA Home Loan

VA Loan

Jumbo Loan

A jumbo loan, also called a jumbo mortgage, is a form of financing that exceeds the limitations of a conventional mortgage (varies by state). It is designed to finance luxury properties but has a higher risk associated with it as it cannot be securitized by Fannie Mae or Freddie Mac (if the borrower defaults, you may not be protected from losses).

USDA Loan

USDA Loan (United States Department of Agriculture) home loan offers zero down payment financing to low-income families in rural areas who do not qualify for a conventional mortgage.

Mortgage Rate Options

Fixed Rate Mortgage

A fixed-rate mortgage is a traditional loan option that offers a fixed- rate for the entire term of the loan.

Adjustable Rate Mortgage (ARMs)

Adjustable-rate mortgages, also referred to as variable-rate mortgage, have interest rate that fluctuates periodically. ARMs typically have a fixed interest rate for the first few years, then the rate may adjust monthly or yearly based on market conditions. Compared to fixed-rates, ARMs often offer lower starting rates, but payments may increase after introductory period ends.

Graduated Payments (GPM)

A graduated payment mortgage is a fixed-rate mortgage option that allows borrowers to start with lower payments and gradually increase over time. This is often a good fit for first-time or young homeowners who may not have the income to qualify for a traditional mortgage but can afford the lower initial payments. This also may be beneficial for borrowers whose incomes are expected to increase gradually overtime.

Interest Only

An interest-only mortgage is a home loan that allows low payments for the introductory period(typically seven to 10 years) and only covers interest owed- not the principal. Payments increase once that period ends. This may benefit borrowers who want to keep their monthly housing costs low and aren’t looking to own a home for a long-term.

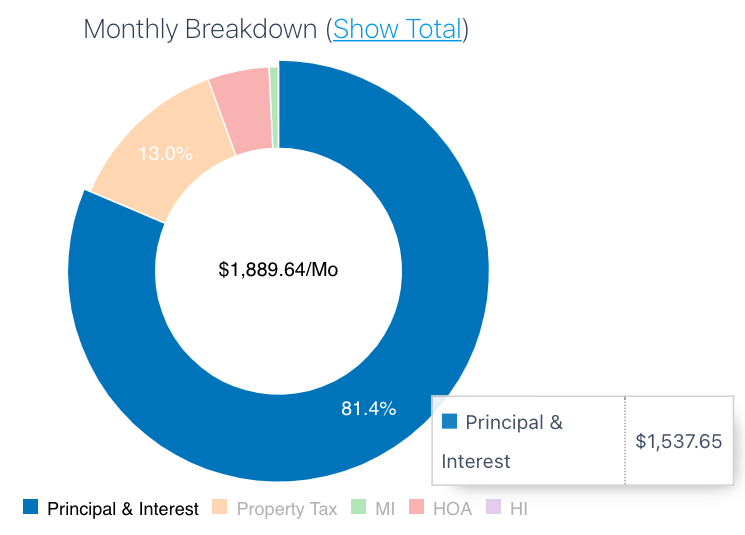

Mortgage Affordability Calculator

Values to consider when calculating monthly payments:

- Home Value

- Down Payment

- Interest Rate (%)

- Amortization Period (Loan Term)

- Start period (First payment is due)

- Annual Property Tax

- Annual Hazard Insurance

- Monthly HOA (Home Owners Association)

- Mortgage Insurance